EGLO 35026 | Lagos-52 Eglo ventilátor stropné diaľkový ovládač časový spínač matná čierna, hnedá | EGLO svietidlá - Svietidlá, lustre, osvetlenie - BON Trade web obchod - svietidlo, luster

Časové relé pod vypínač SMR-T multifunkčné pre ventilátor | iElektra.sk - elektroinstalačný materiál

Časové relé pod vypínač SMR-T multifunkčné pre ventilátor | iElektra.sk - elektroinstalačný materiál

Vetrací ventilátor s filtrom, 250×250mm, 170/230 m3/h, 230V 50/60Hz, IP54, Ventilátor s mriežkou a filtrom – Príslušenstvo, doplnky – Rozvodné skrine – Tracon Electric

EGLO 35091 | Bondi-1 Eglo ventilátor stropné diaľkový ovládač časový spínač, UV vzdorný plast UV matná čierna | Svietidlá odolné voči nárazu a UV žiareniu - Svietidlá, lustre, osvetlenie - BON Trade web obchod - svietidlo, luster

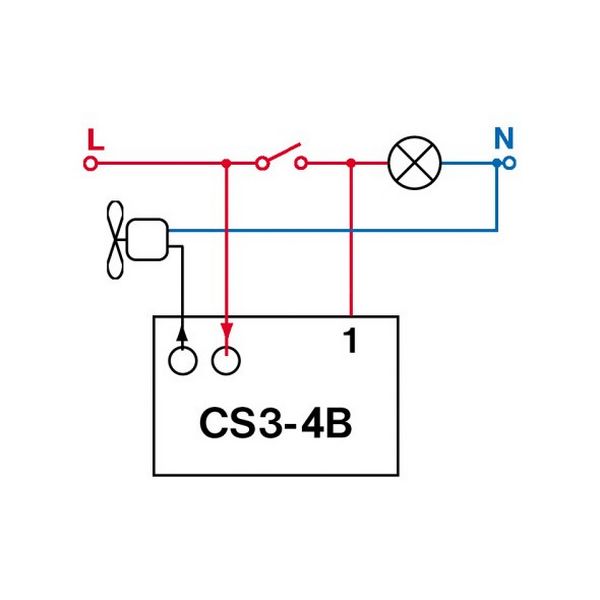

Časové relé pod vypínač SMR-T multifunkčné pre ventilátor | iElektra.sk - elektroinstalačný materiál

Časové relé pod vypínač SMR-T multifunkčné pre ventilátor | iElektra.sk - elektroinstalačný materiál

Krabicový vačkový vypínač, ON-OFF, 400V, 50Hz, 32A, 3P, 11kW, 64×64mm, 90°, IP44, Vačkový vypínač – Vačkový spínač – Silnoprúdové prvky – Tracon Electric