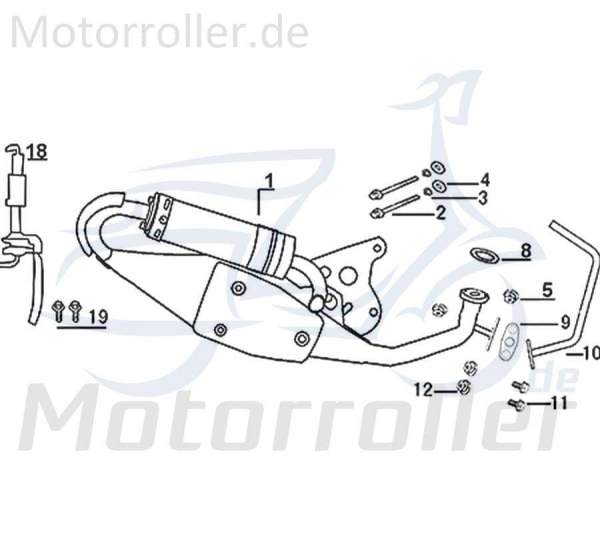

Jonway Florett 2.0 50 City Auspuff Roller 50ccm 2Takt 741616 Endschalldämpfer Auspuffanlage Endtopf Auspuff-Anlage Auspufftopf Scooter

Auspuff Tecnigas Q-TRE für Minarelli liegend - mit ABE | Heavy Tuned: Günstige Preise für Rollerteile, Motorrad Ersatzteile, Mofa, Vespa & mehr

Auspuff / Sportauspuff Giannelli Rekord für Minarelli liegend | Heavy Tuned: Günstige Preise für Rollerteile, Motorrad Ersatzteile, Mofa, Vespa & mehr

Auspuff Akrapovic Racing Line für Piaggio Liberty, Vespa Primavera, Sprint 125, 150ccm iGet Euro4 | Heavy Tuned: Günstige Preise für Rollerteile, Motorrad Ersatzteile, Mofa, Vespa & mehr

Jfg Racing Universal-Auspuff-Schalldämpfer zum Aufstecken 3,8–5,1 cm Einlass-Sechskantschalldämpfer für Roller, Motorrad, ATV, Gelände-, Straßenmotorrad : Amazon.de: Auto & Motorrad

Sportauspuff Tuning Auspuff für CPI Aragon Hussar Oliver, Keeway RY 6 8 Matrix, Generic/Explorer Spin ATU, Rivero GP Linos Phoenix Racing SP 2 VR XR, Sachs Eagle SX1 Speedforce Speedjet 50 :

Neu! QUADRO S-350 2013-2016 GPR POWER-BOMB Sport-auspuff Roller in Bayern - Brunnen | Motorradteile & Zubehör | eBay Kleinanzeigen ist jetzt Kleinanzeigen

AUSPUFF HOMOLOGIERT MSR ROLLER QUADRO 350 QV3 3 2020 CLASSIC RUNDE EDELSTAHL ENDE DER SERIE - SCOT.1714.CTAI.PROMO

PGO Auspuff 110ccm 2Takt 90ccm Motorroller Scooter P82810000001 Endschalldämpfer Auspuffanlage Endtopf Auspuff-Anlage Auspufftopf

![FAQ] Übliche Drosseln beim Roller Auspuff + Sportauspuff / Sammlung & entfernen - YouTube FAQ] Übliche Drosseln beim Roller Auspuff + Sportauspuff / Sammlung & entfernen - YouTube](https://i.ytimg.com/vi/6I9PPcETXnk/maxresdefault.jpg)